BitViraj Technologies - Your Gateway to

Tomorrow's Innovations

Unlocking the Next Wave: How Blockchain and AI Are Fueling the Transformation of India's MSME Ecosystem

India's Micro, Small, and Medium Enterprises (MSMEs) are the silent engine of the economy, contributing nearly 30% of GDP. A powerful convergence of Digital Public Infrastructure, AI, and Blockchain is laying the foundation for a new MSME era—one defined by formalization, transparency, efficiency, and global competitiveness.

Published by: Bitviraj Technology

Unlocking the Next Wave: How Blockchain and AI Are Fueling the Transformation of India's MSME Ecosystem

Introduction: India's MSMEs at an Inflection Point

India's Micro, Small, and Medium Enterprises (MSMEs) are the silent engine of the economy. They contribute nearly 30% of GDP, account for ~45% of exports, and employ over 110 million people. Yet, despite their scale and importance, MSMEs have long operated under structural disadvantages—informality, limited access to credit, fragmented supply chains, and low operational efficiency.

Today, this is changing.

A powerful convergence is underway:

Government-led Digital Public Infrastructure (DPI)

Emerging deep technologies like AI and Blockchain

Together, they are laying the foundation for a new MSME era—one defined by formalization, transparency, efficiency, and global competitiveness.

The MSME Landscape: Immense Potential, Persistent Challenges

Growth Catalysts Reshaping the Ecosystem

Government Push for Formalization and Scale

Initiatives such as Udyam Registration, Production Linked Incentive (PLI) schemes, and the rise of ONDC (Open Network for Digital Commerce) are creating structured pathways for MSMEs to formalize operations, access markets, and integrate into national and global value chains.

Digital India and India Stack

India Stack—Aadhaar, UPI, e-KYC, DigiLocker, and Account Aggregator—has digitally onboarded millions of small businesses. Even micro-entrepreneurs can now transact, verify identity, and access financial services digitally.

Post-COVID Digital Resilience

The pandemic forced MSMEs to adopt digital tools for payments, sales, logistics, and customer engagement. This acceleration has permanently altered how small businesses operate.

The Persistent Roadblocks

Despite progress, systemic challenges remain:

The Credit Gap:

An estimated $1.5 trillion MSME credit gap (IFC), driven by lack of collateral, thin credit histories, and informal operations.

Supply Chain Inefficiencies:

Fragmented and opaque supply chains cause delays, inventory mismatches, and difficulty in proving product provenance.

Market Access & Trust Deficit:

MSMEs struggle to establish credibility with large enterprises, financial institutions, and international buyers.

Operational Inefficiency:

Manual invoicing, inventory tracking, compliance, and reconciliation consume time and limit scalability.

Incremental solutions are insufficient. What MSMEs need is a re-architecture of trust and efficiency.

The Deep Tech Intervention: AI and Blockchain as Game Changers

Artificial Intelligence (AI): The Efficiency Engine

AI enables MSMEs to operate with the intelligence and precision of large enterprises—without equivalent resources.

AI-Powered Credit Underwriting

Traditional lending relies on balance sheets and collateral. AI models can analyze alternative data such as:

Transaction history (UPI, GST)

Invoice flows

Cash flow patterns

Account Aggregator data

This enables faster, more inclusive credit decisions for underserved MSMEs.

Predictive Analytics for Demand Forecasting

AI models analyze historical sales, seasonality, and market trends to:

Optimize inventory

Reduce waste

Improve production planning

For example, a small apparel manufacturer can forecast which designs or SKUs will be in demand next season.

Hyper-Personalized Marketing

AI-driven tools allow MSMEs to:

Segment customers intelligently

Run targeted campaigns

on WhatsApp, Instagram, and marketplaces

Compete with larger brands

at a fraction of the cost

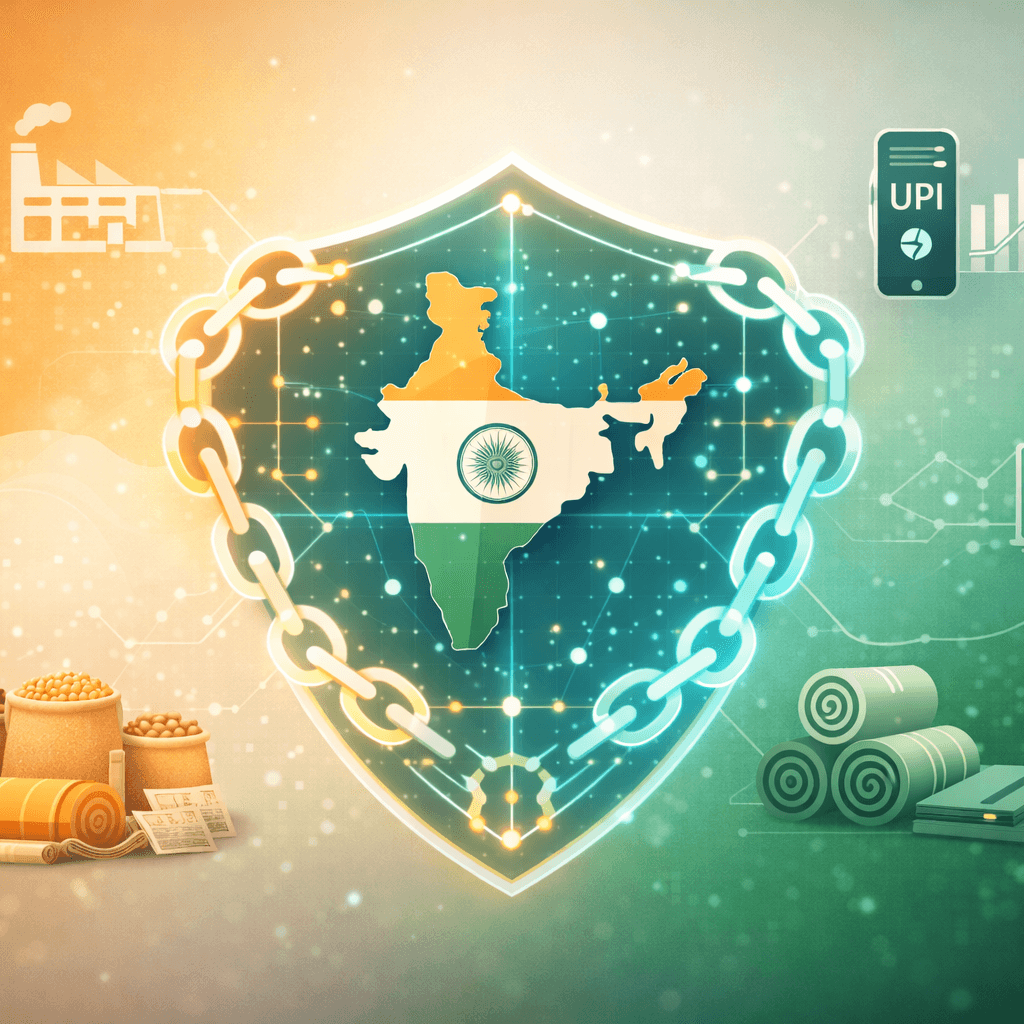

Blockchain: The Trust Layer

If AI drives efficiency, Blockchain establishes verifiable trust—a critical currency for MSMEs.

Supply Chain Provenance & Transparency

Blockchain enables immutable tracking of goods from source to destination. MSMEs can prove:

Origin

Quality certifications

Ethical sourcing

This is especially valuable for exports, food, textiles, and manufacturing.

Streamlined Trade Finance

Blockchain-based records of purchase orders, invoices, and shipment milestones reduce fraud and enable lenders to finance transactions with higher confidence.

Tamper-Proof E-Way Bills & Invoicing

Blockchain-based invoicing systems can create:

Immutable, verifiable invoices

Automated GST reconciliation

Reduced disputes and audit friction

This simplifies compliance while improving trust across buyers, sellers, and regulators.

The Real Breakthrough: AI + Blockchain Together

The true transformation emerges when AI and Blockchain converge.

A Real-World Scenario: An MSME Spice Exporter

Pre-Shipment

AI analyzes global demand, pricing trends, and commodity cycles to recommend optimal pricing and timing.

During Shipment

Purchase orders, quality certifications, and shipment data are logged on-chain. A smart contract governs the transaction.

Finance

A lender's AI model analyzes immutable blockchain data—order value, shipment status, cash flows—and approves pre-shipment finance instantly.

Post-Shipment

IoT-based verification confirms delivery. The smart contract:

- Releases payment from buyer to exporter

- Automatically settles the loan with the lender

This creates a seamless, trustless, and automated trade-finance loop—previously impossible for MSMEs.

The Road Ahead: Challenges to Scale

Despite immense promise, adoption hurdles remain:

Awareness & Digital Literacy

Many MSME owners are unfamiliar with AI and blockchain. Education and trust-building are critical.

Cost & Integration

Enterprise-grade solutions are expensive. SaaS-based, plug-and-play platforms are essential for mass adoption.

Regulatory Clarity

Clear guidance is needed on:

- Data privacy (DPDP Act)

- Legal validity of smart contracts

- Recognition of blockchain records

Interoperability

Solutions must integrate seamlessly with GSTN, ONDC, banking systems, and India Stack.

Conclusion: Building the Backbone of a $5 Trillion Economy

India's MSME sector stands at a defining moment.

The foundational digital rails — India Stack and DPI — are already in place.

The next wave of growth will be powered by deep tech adoption.

Leveraging AI

for intelligent decision-making

Using Blockchain

for immutable trust and transparency

MSMEs can finally overcome decades-old structural constraints.

The reward is immense:

A formalized, efficient, and globally competitive MSME ecosystem — one capable of anchoring India's ambition of becoming a $5 trillion economy.

At Bitviraj Technology, we believe this transformation is not optional.

It is inevitable — and it has already begun.

Case Studies

Empowering Digital

Evolution

Blogs

Empowering Digital

Evolution

BitViraj Technologies - Your Gateway to

Tomorrow's Innovations

Embark on a DigitalJourney

The next-generation digital technology company Bitviraj has the potential to empower and reinvent business in the current fast-paced market.

Our Service

- Website Development

- Application Development

- Blockchain Development

- Gaming and Metaverse