BitViraj Technologies - Your Gateway to

Tomorrow's Innovations

AI Agents Will Be the Next User in DeFi: A Comprehensive Analysis of AI Agent Use Cases, Market Growth, and Real-World Impact

The convergence of artificial intelligence (AI) and decentralized finance (DeFi) represents one of the most profound shifts in the modern financial ecosystem. AI agents are autonomous financial participants executing trades, reallocating capital, and managing billions in agentic volume.

AI Agents Will Be the Next User in DeFi: A Comprehensive Analysis of AI Agent Use Cases, Market Growth, and Real-World Impact

Overview

The convergence of artificial intelligence (AI) and decentralized finance (DeFi) represents one of the most profound shifts in the modern financial ecosystem. Unlike traditional finance—defined by gatekeepers, NDAs, closed data, and proprietary APIs—DeFi is permissionless, programmable, transparent, and settles in milliseconds.

These characteristics make DeFi not just compatible with AI agents, but native to them.

As of 2025, AI agents are no longer experimental curiosities. They are autonomous financial participants—executing trades, reallocating capital, managing risk, and coordinating across protocols in real time. Some already manage billions of dollars in aggregate agentic volume.

This analysis synthesizes market data, adoption statistics, and real-world deployments to support a clear conclusion:

The bottleneck for AI agents in DeFi is no longer infrastructure.

It is imagination.

The AI Agent Market Explosion

Global Market Size & Growth Trajectory

The AI agent economy is expanding at an unprecedented pace:

$7.6B

Market valuation in 2025

(up from $5.4B in 2024)

$47.1B

Projected size by 2030

45.8%

CAGR (2025–2030)

68%

Projected AI market share by 2030

of $594B global AI market

Agent-based systems are rapidly becoming the dominant interface between software and economic activity.

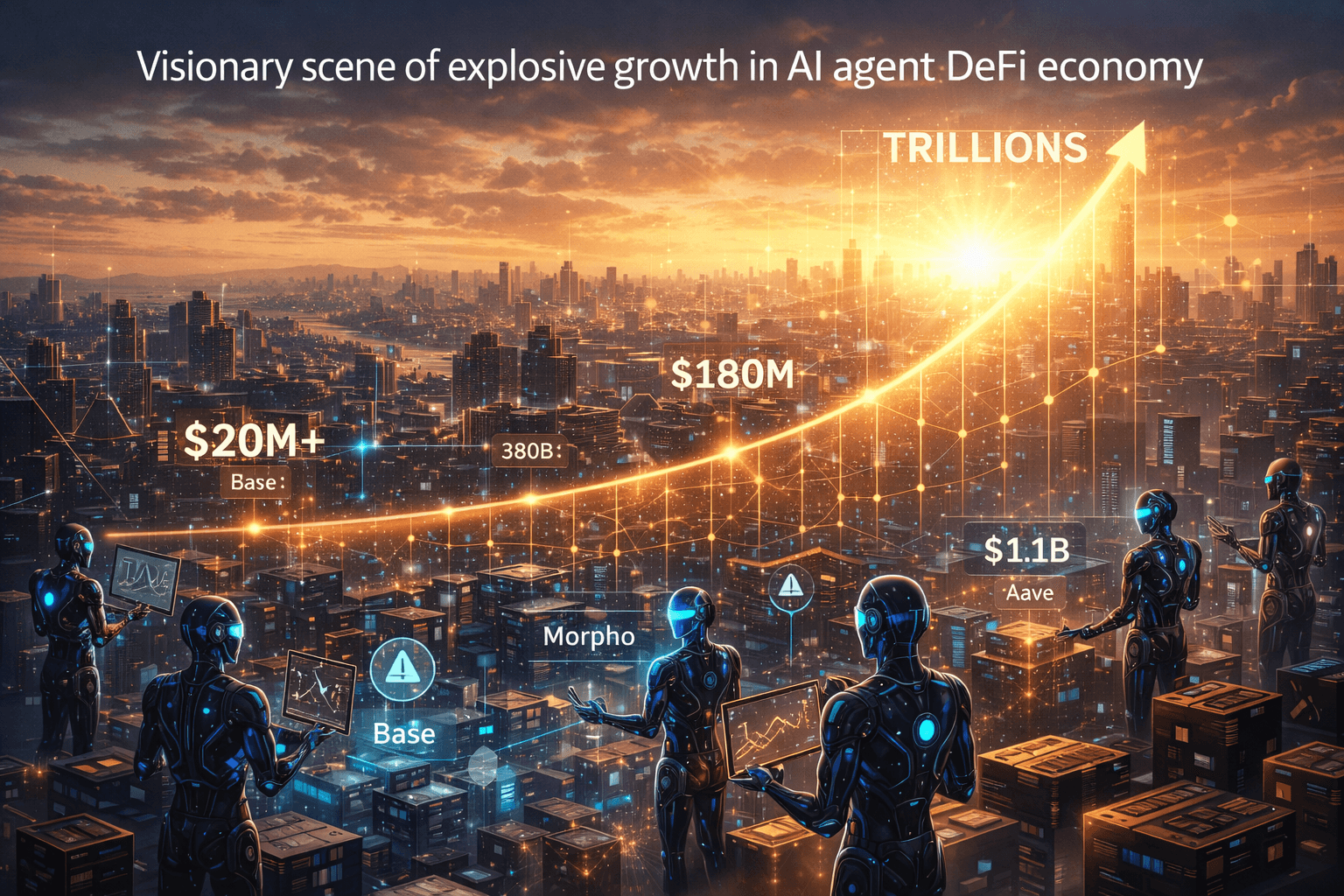

Crypto-Native AI Agent Growth

The intersection of AI and crypto is accelerating even faster:

Q4 2024

AI agent crypto market value surged

$4.8B → $15.5B

in 3 months

AI Token MCAP

$23B → $50.5B

mid-2024 to Feb 2025

$3.8B

VC raised by AI agent startups in 2024

Nearly 3× YoY growth

Capital is flowing not into theory, but into production-grade agent systems.

Enterprise Adoption Signals

AI agents are no longer confined to startups:

Enterprises in Production

51%

Planning Deployment

78%

Financial Services:

By 2028, 33% of enterprise software will include agentic AI (up from <1% in 2024)

Finance is leading this transformation—and DeFi is its most natural execution layer.

AI Agents as Native DeFi Participants

DeFi was unintentionally designed for autonomous agents:

No permission required

No proprietary APIs

Fully observable state

Programmatic asset control

Near-instant settlement

For AI agents, DeFi is not an integration challenge—it is home territory.

Core AI Agent Use Cases in DeFi

1. Yield Farming & Liquidity Optimization

Autonomous yield optimization is one of the most mature agentic use cases.

Real-world example: Arma Agents (launched Nov 2024)

TVL Growth

$200K → $11.2M

in 7 months

5,500% increase

Agents

33,000

executing strategies

Cumulative Volume

$324M

agentic volume

Protocols

Allocate USDC across

Morpho, Moonwell, Aave

By June 2025, stablecoin-focused AI agents exceeded $20M TVL on Base alone, signaling institutional-grade confidence in automated yield strategies.

2. Arbitrage & Statistical Trading

AI agents outperform humans in fragmented, high-velocity markets:

Win Rates

>70%

in backtested futures grid strategies

Execution

Millisecond-level

trade execution

Availability

24/7

operation across global markets

Cross-chain

Exploiting price inefficiencies across L1s and L2s

Notable case:

On Polymarket, an account (AlphaRaccoon) generated $1M+ by winning 22 out of 23 bets, a level of consistency strongly indicative of ML-driven decision-making.

3. Lending & Risk Management

AI agents continuously monitor:

Collateral ratios

Liquidation thresholds

Interest rate movements

Protocol-level risk

They dynamically rebalance positions—something humans cannot do at scale without automation.

4. Market Sentiment & Price Prediction

Advanced agents combine:

On-chain flows

Order-book dynamics

Social sentiment

(X, Telegram, Discord)

They trade on emerging narratives before markets fully price them in, creating a new form of AI-driven information asymmetry.

Real-World Business & Economic Impact

Enterprise Efficiency

Average efficiency gain

43%

Annual cost savings

~$2.3M

per deployed agent

For DeFi trading desks and crypto funds, these gains directly translate to higher alpha per unit of capital.

Revenue & Macroeconomic Impact

Revenue uplift

6–10%

for companies adopting agentic AI

GDP contribution by 2030

$2.6T

low estimate

–

$4.4T

high estimate

(PwC estimate)

Finance is the highest-impact vertical.

Challenges & Emerging Risks

Despite rapid growth, risks remain.

Data Quality & Integration

- •On-chain data is clean, but off-chain sentiment and macro inputs introduce latency and bias

- •Poor data → catastrophic decisions at machine speed

The "Black Box" Problem

- •Users delegate capital without fully understanding agent reasoning

- •Transparency and explainability are unresolved challenges

Herd Behavior & Systemic Risk

- •Similar strategies deployed at scale could amplify volatility

- •Cascading liquidations remain a real concern

Regulatory Uncertainty

- •AI agents operate across jurisdictions

- •Compliance frameworks lag far behind deployment reality

Why DeFi Is Purpose-Built for AI Agents

Traditional finance cannot replicate these properties:

No gatekeepers

Permissionless deployment

Fully programmable

Smart contracts as native execution

Fast settlement

Near-real-time finality

Radical transparency

Verifiable state at all times

Native incentives

Tokens enable AI-to-AI economies

DeFi is not just compatible with AI agents—it is optimized for them.

The Real Bottleneck: Imagination

The technology stack is ready:

Agent frameworks

Fetch.ai, SingularityNET, Autonolas

Scalable L2s

Mature smart contract platforms

What's missing is new mental models.

Early prototypes already include:

Pump-and-dump detection agents

Reinforcement-learning lending optimizers

Uniswap v3 active liquidity managers

Fully autonomous perpetual futures traders

These exist today—at small scale.

The unanswered question is not "can this work?"

It is "what else becomes possible when software becomes a financial actor?"

2025–2026 Outlook

Likely next-phase developments:

Agent-to-agent economies

Autonomous negotiation and coordination

AI-driven DAO governance

Delegated voting by analytical agents

Cross-chain orchestration

Unified capital management across ecosystems

Clearer regulation

Reduced uncertainty for institutional deployment

Institutional adoption

Hedge funds and asset managers deploying agentic crypto stacks

Conclusion

AI agents represent a fundamental shift, not an incremental upgrade.

For the first time, software can:

Observe markets

Learn from outcomes

Allocate capital

Act autonomously

DeFi's open, programmable architecture makes it the ideal substrate for this transformation.

By mid-2025, AI agents had already captured $20M+ TVL on Base alone.

Growth is exponential. Capital, talent, and infrastructure are aligned.

The infrastructure exists.

The standards are emerging.

The market signals are clear.

The next major user in DeFi will not be human.

It will be an AI agent.

And the only remaining constraint is imagination.

Case Studies

Empowering Digital

Evolution

Blogs

Empowering Digital

Evolution

BitViraj Technologies - Your Gateway to

Tomorrow's Innovations

Embark on a DigitalJourney

The next-generation digital technology company Bitviraj has the potential to empower and reinvent business in the current fast-paced market.

Our Service

- Website Development

- Application Development

- Blockchain Development

- Gaming and Metaverse