BitViraj Technologies - Your Gateway to

Tomorrow's Innovations

Top Asset Global Tokenization Platforms for the Global Financial Industry (2026)

From pilots to production-scale deployment

Tokenized financial assets have decisively moved beyond experimentation. While adoption is still uneven, financial institutions with production-grade blockchain infrastructure now hold a structural advantage in settlement efficiency, balance-sheet optimization, and access to new real-world asset (RWA) markets.

Below is a comprehensive, global view of leading regulated asset-tokenization platforms, spanning banks, infrastructure providers, capital-market intermediaries, and blockchain-native middleware.

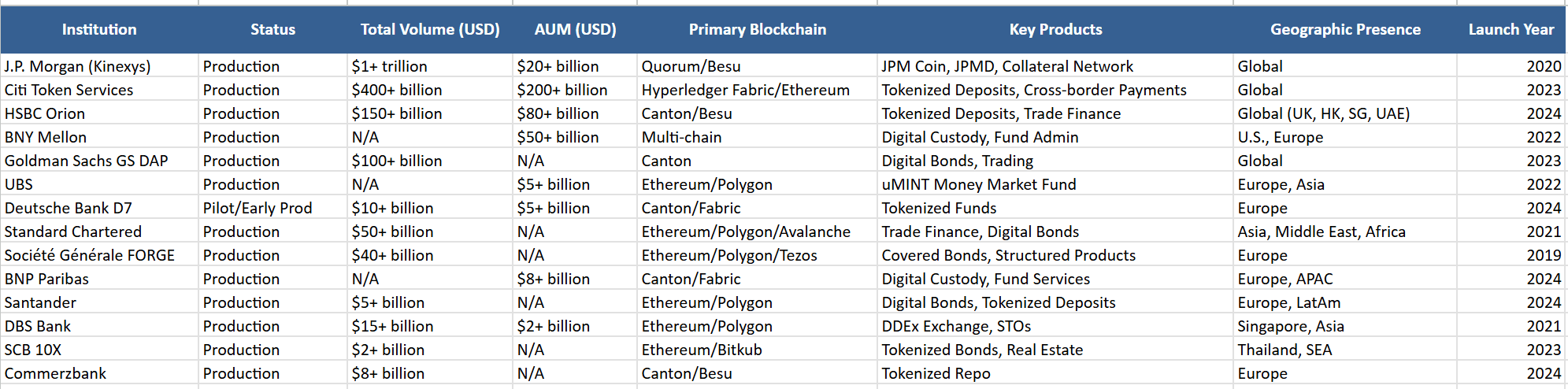

Bank-Led & Financial Institution Platforms (Live / Advanced Pilots)

Global Systemically Important Banks (G-SIBs)

| Bank | Platform/Service | Focus Areas |

|---|---|---|

| J.P. Morgan | Kinexys (formerly Onyx) | Tokenized deposits, intraday repo, collateral mobility, wholesale settlement (JPM Coin, JPMD) |

| Citi | Citi Token Services | Tokenized deposits, programmable treasury, cross-border liquidity management |

| HSBC | Tokenised Deposit Service | Tokenized deposits, DLT-based payments, intrabank settlement |

| BNY Mellon | - | Tokenized fund servicing, digital asset custody, on-chain NAV servicing |

| Goldman Sachs | GS DAP | Tokenized bonds, structured products, digital issuance platform |

| UBS | - | Tokenized money market funds, bonds, structured notes |

| Deutsche Bank | - | Tokenized funds, custody, collateral management (Project DAMA, D7) |

| Standard Chartered | - | Tokenized trade finance, digital bonds, RWA pilots in Asia & Middle East |

Bank Tokenization Platforms Visualization

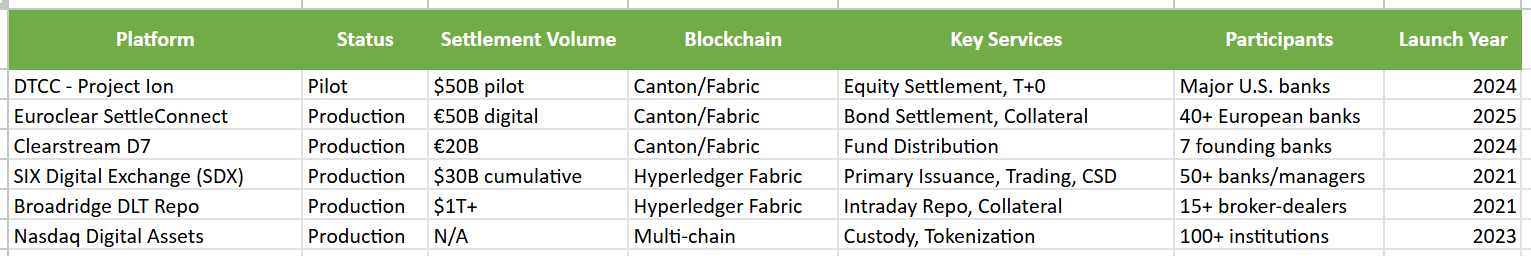

Market Infrastructure & Capital Markets Platforms

Broadridge

Tokenized repo, collateral management, post-trade processing (DLT Repo)

DTCC

Tokenized clearing, settlement, fund processing (Project Ion, Project Whitney)

Euroclear

Tokenized securities settlement, DLT collateral mobility

Clearstream

Digital issuance and custody for tokenized securities

Nasdaq

Digital asset issuance, custody, and market infrastructure tooling

Market Infrastructure Platforms Visualization

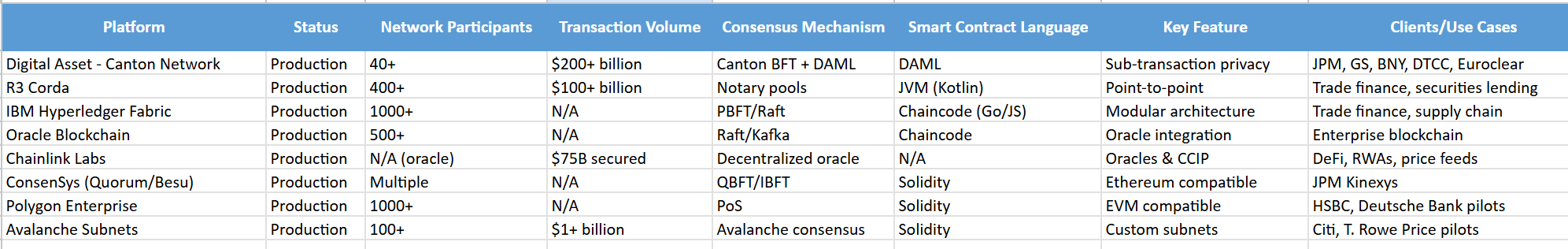

Blockchain Infrastructure & Middleware (Institutional-Grade)

IBM – Fabric-X

Permissioned tokenization for regulated assets and supply-chain finance

Oracle

Blockchain infrastructure for asset lifecycle management and enterprise integration

Chainlink Labs

Oracles, proof-of-reserve, cross-chain interoperability (CCIP) for RWAs

Canton Network

Privacy-preserving, interoperable DLT for regulated financial institutions

R3 – Corda

Tokenized bonds, loans, trade finance, bank-to-bank settlement

Digital Asset

DAML smart contracts powering Canton & regulated market workflows

Blockchain Infrastructure Visualization

System Integrators & Enterprise Enablers

Tata Consultancy Services

End-to-end tokenization platforms for banks, exchanges, and custodians

Accenture

Tokenized capital markets, CBDC & RWA infrastructure design

Infosys

Tokenized assets, trade finance, and DLT modernization

Wipro

Blockchain-based asset servicing and digital custody platforms

Token Layer

Tokenization as Service platform for banking and fintech institutions

Blockchain-Native Tokenization Platforms (Institutional Focus)

Kaleido

Enterprise-grade tokenization on Ethereum-compatible networks

Fireblocks

Secure issuance, custody, and transfer of tokenized assets

Securitize

Tokenized funds, equities, bonds (used by BlackRock, Hamilton Lane)

Tokeny

Regulated security token issuance (ERC-3643)

Onyx by J.P. Morgan

Institutional settlement and tokenized cash infrastructure

Asset Managers & Fund Tokenization Leaders

BlackRock – BUIDL

Tokenized money market funds, on-chain collateral

Franklin Templeton

On-chain mutual funds and government money funds

WisdomTree

Tokenized ETFs, funds, and wallets

Hamilton Lane

Tokenized private equity and credit funds

What Assets Are Being Tokenized Today

Bank deposits & commercial money

Government & corporate bonds

Money market funds

Repo & collateral instruments

Private credit & private equity

Trade finance receivables

Commodities & carbon credits

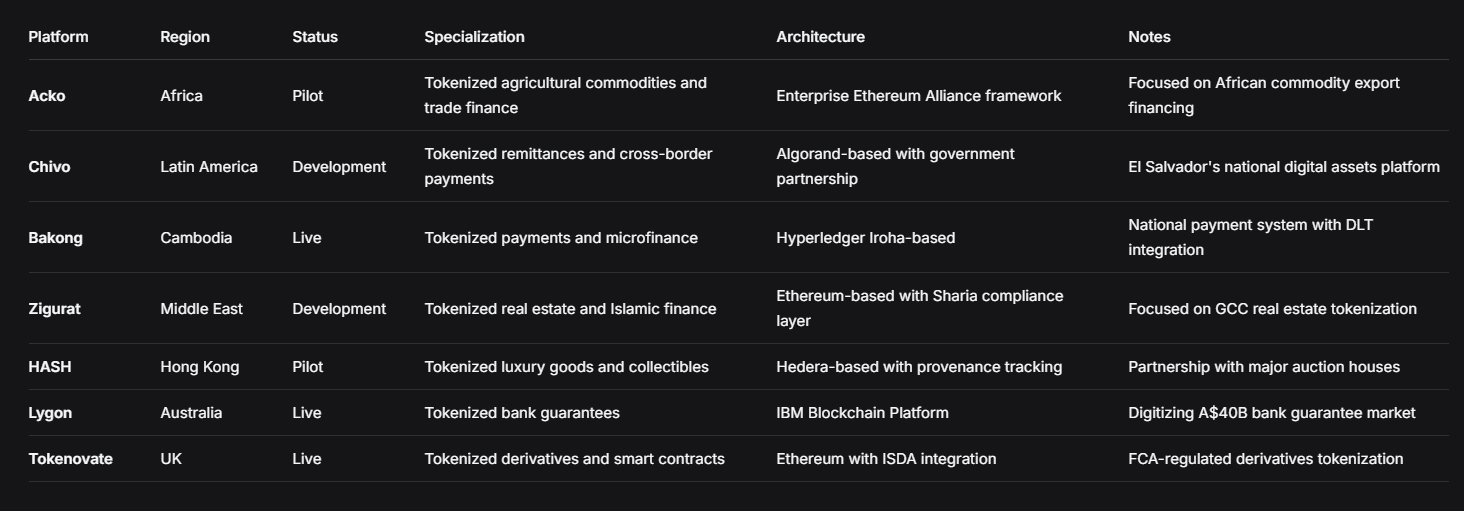

Emerging Regional & Specialized Platforms Visualization

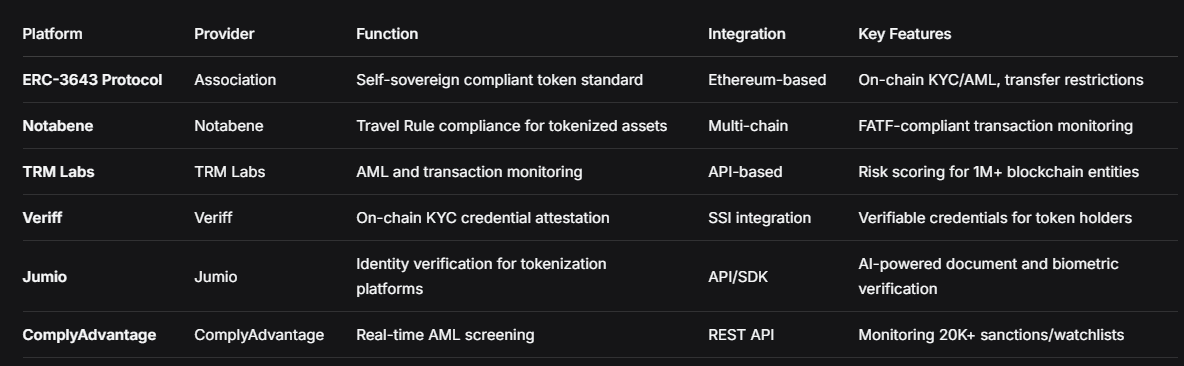

Regulatory & Compliance Infrastructure Visualization

KEY ARCHITECTURAL TRENDS 2026

Dominant Models:

1. Private Permissioned Networks

JPM, DTCC, Euroclear, R3 Corda (for regulated institutional settlement)

2. Public Blockchain + Compliance Layer

Securitize, Tokeny, Backed (ERC-3643/1400 standards)

3. Hybrid/Interoperable Networks

Canton Network, Chainlink CCIP, Libre (bridging public/private)

4. App-Specific Chains

Polygon CDK, Provenance.io, Centrifuge Chain (optimized for specific asset classes)

Volume & Adoption Metrics

- Institutional Settlement$100B+ daily

- Tokenized Funds$2B+ AUM

- DeFi RWAs$2.5B+ TVL

- Digital Bonds$5B+ issued

- Tokenized Deposits (Projected 2027)$50B+

Interoperability Focus

Cross-Chain Bridges

Wormhole, Axelar, LayerZero facilitating asset movement

Unified Ledger Projects

BIS Project Agorá, Regulated Liability Network

Standardization

ERC-3643 gaining traction over ERC-20 for regulated securities

STRATEGIC LANDSCAPE ANALYSIS

Market Position by Segment

Settlement & Collateral Efficiency

JPM Kinexys, DTCC, Broadridge

Fund Tokenization

BlackRock (BUIDL), Franklin Templeton, Hamilton Lane

Digital Bond Market

SG Forge, UBS, European Investment Bank partners

DeFi-Native RWA

Centrifuge, MakerDAO, Goldfinch

Compliance Infrastructure

Chainlink, Tokeny (ERC-3643), Notabene

Growth Projections (2026-2027)

- →

Tokenized Deposits

5-10% of major bank deposits

- →

On-Chain Funds

$10-20B AUM across public/private platforms

- →

Digital Bond Issuance

10-15% of new corporate bond issuance in Europe/Asia

- →

RWA in DeFi

$10-15B TVL as real yield becomes primary DeFi narrative

Critical Success Factors

Regulatory Alignment: Platforms integrated with national regulators (FCA, MAS, FINMA) leading

Institutional Connectivity: Direct integration with traditional settlement systems (DTCC, Euroclear)

Comprehensive Stack: End-to-end solutions (issuance, custody, secondary trading) vs. point solutions

Cross-Chain Capability: Ability to operate across multiple blockchain environments

Strategic Takeaway

Tokenization is becoming core financial market infrastructure, not a side experiment.

Banks

→ Tokenized deposits & settlement rails

Asset managers

→ Tokenized funds & collateral

FMIs

→ On-chain clearing & settlement

Enterprises

→ Programmable ownership & automation

Institutions that deploy tokenization early will benefit from:

- Real-time settlement

- Balance-sheet efficiency

- Fractionalized access to private markets

- Cross-border liquidity without legacy friction

The race is no longer about whether to tokenize assets—but who controls the rails, standards, and interoperability layer of global finance.

CONCLUSION: THE TOKENIZATION MATRIX

The tokenization landscape has evolved into a four-quadrant matrix:

1. High Regulation, High Value

Bank/FMI platforms (JPM, DTCC) - focused on balance sheet efficiency

2. High Regulation, Retail Access

Asset manager platforms (BlackRock, WisdomTree) - focused on product democratization

3. Lower Regulation, Institutional

Blockchain-native platforms (Fireblocks, Securitize) - focused on infrastructure

4. Lower Regulation, Retail/DeFi

Centrifuge, Backed - focused on new financial primitives

Winning platforms in 2027 will:

- ✓Operate across multiple quadrants

- ✓Master both private and public blockchain architectures

- ✓Embed regulatory compliance at the protocol level

- ✓Demonstrate clear ROI through settlement efficiency or new revenue streams

- ✓Build robust interoperability with both TradFi and DeFi ecosystems

The tokenization race is no longer about technology experimentation but about financial market restructuring - with $16T+ in asset value projected to be tokenized by 2030, controlling the rails means controlling the future of global finance.

Case Studies

Empowering Digital

Evolution

Blogs

Empowering Digital

Evolution

BitViraj Technologies - Your Gateway to

Tomorrow's Innovations

Embark on a DigitalJourney

The next-generation digital technology company Bitviraj has the potential to empower and reinvent business in the current fast-paced market.

Our Service

- Website Development

- Application Development

- Blockchain Development

- Gaming and Metaverse